Corporate Governance

Corporate Governance

Corporate Governance and Compliance Framework

IRM which manages ADR’s assets, has established a corporate governance framework by setting up investment and compliance committees to oversee the execution of corporate governance and defined its commitments to its fiduciary duty.

With the framework in place, IRM endeavors to manage risks, to comply to laws and regulations and ensure fair handling of transactions with conflict of interest,

Please refer here for details on the compliance framework.

Please refer here on measures to insure fair handling of transactions with conflict of interests.

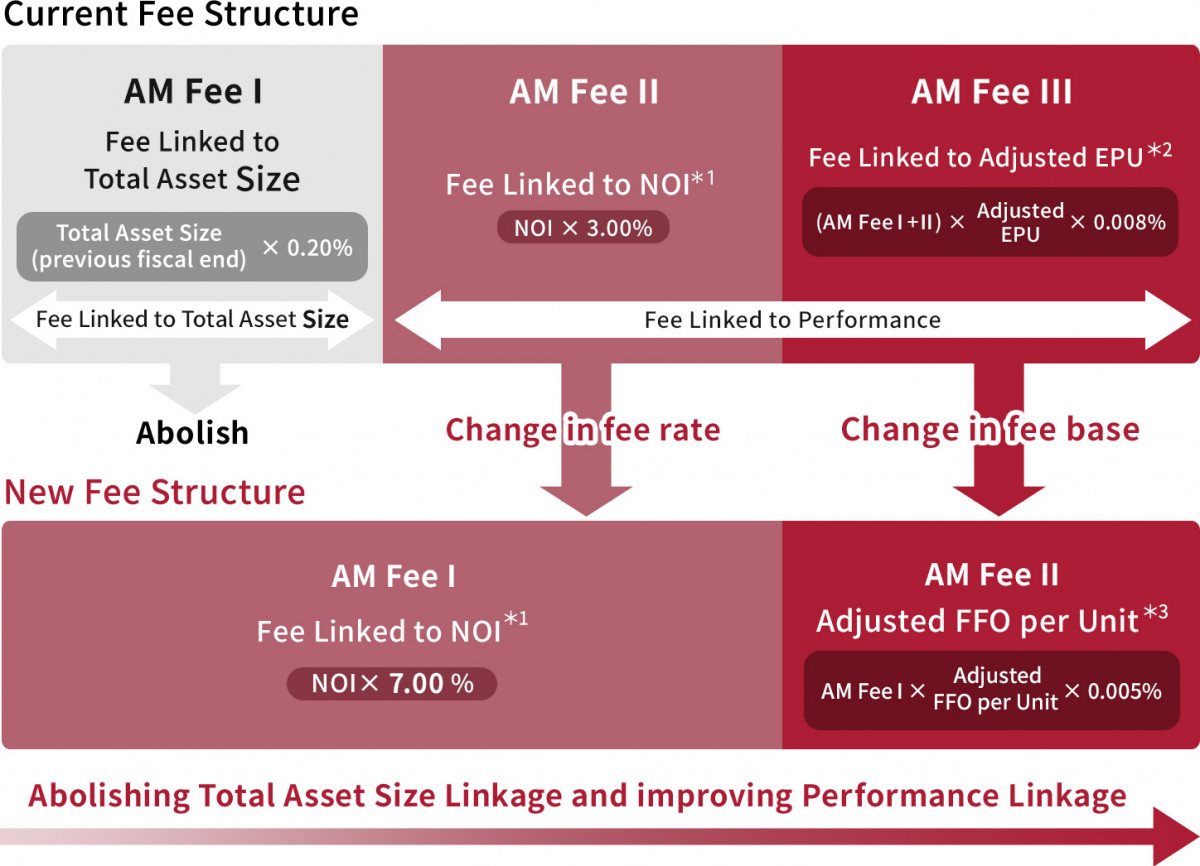

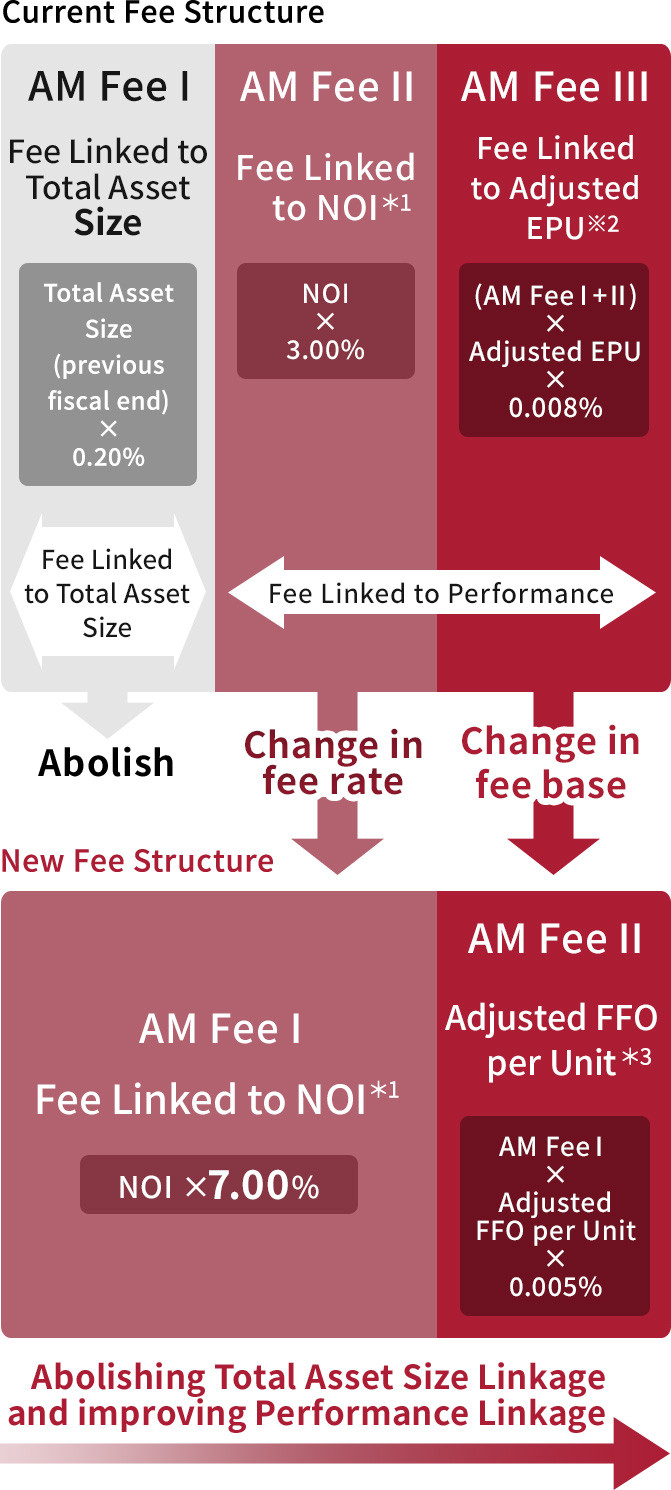

Management Fee Structure

The asset management fee shown on the table below paid from ADR to IRM took effect from February 1, 2020.

It is because of simplifying the fee structure and strengthening the link between ADR’sperformance and unitholders’ interests to the amount of fees paid to the asset management company.

Asset Management Coupled to NOI*1and Adjusted EPU*2

*1 NOI=Gross Operating Income minus Gross Operating expense (excluding depreciation and loss from fixed asset retirement)

*2 Adjusted EPU=Net profit excluding AM Fee III / Number of investment units issued as of the closing date of the accounting term

*3 Adjusted FFO per Unit=(Net profit excluding AM Fee II + depreciation expense - gains on transfer of real estate + losses on transfer on real estate + impairment losses) / Number of investment units issued as of the closing date of the accounting term.

Preventing Misconduct and Corruption

IRM recognizes that legal compliance is a matter of course, and that IRM must continue to be an organization that is trusted by society. IRM have established various rules and prevention system.

Disclosure of rewards

The executive compensation of ADR officers is determined as follows based on the Investment Corporation Agreement. In addition, please refer to the fiscal report for the specific amount of compensation.

(1)The maximum monthly remuneration for executive officers is 1 million yen, which is determined by the board of directors as an amount that is judged to be reasonable in general price trends and wage trends.

(2)The maximum monthly remuneration for supervisors is 500,000 yen per person, and the board of directors decides the amount as it is judged to be reasonable in general price trends and wage trends.

Performance on Compliance and Prevention of Misconduct and Corruption

IRM holds a wide range of compliance training tailored to the target.

Please see the link below for details on the training outline and the results of compliance cases.

Disclosure

In order to ensure disclosure transparency, in addition to statutory disclosures, ADR will disclose information it deems useful and valuable on timely bases in an easy-to-understand form. Specifically, ADR will actively disclose information on its website in addition to disclosing on the Tokyo Stock Exchanges disclosure system (TDnet).

Please click here to read the disclosures.

Please refer here for information on investor meetings and conferences.

Results of Investor Relations Activities

|

Target |

IR activities |

FY2022 |

|---|---|---|

|

Individual investors |

Earnings briefings and seminars |

4 times |

|

Institutional investors |

Earnings briefings |

2 times |

|

IR meetings (Japan) |

108 companies |

|

|

IR meetings (overseas) |

71 companies |

Legal and Regulatory Restrictions

- The executive director and the supervisory directors of ADR are not allowed to transact ADR units for itself or for a third-party in accordance to ADR’s bylaw.

- If the executive director and the supervisory directors of ADR commit illegal or improper acts or make improper profits, they may be punishable not only by law but by accordance to ADR’s bylaw.

- Rights of unit-holders are defined in the “Act on Investment Trust and Investment Corporations” and “Articles of Incorporation of Investment Corporation”. For detail please refer to ADR’s financial report (in Japanese only) submitted to the Financial Services Agency.

- The compensation to the directors of ADR is restricted by the Articles of Incorporation of ADR, in which payment rules(An amount determined by the board of directors as an amount deemed reasonable in light of general price trends, wage trends, etc., within the maximum monthly amount set in the Articles of Incorporation.)are laid down.

- Due to the legal system, J-REITs cannot issue class shares (investment units that differ from ordinary investment units in terms of rights such as dividends and distribution of residual assets, or voting rights, etc.; so-called "class units") similar to class shares under the Companies Act. ADRs do not issue such class units because J-REITs are not allowed to issue such units.

- Partners of ADR's auditor cannot be in charge of auditing for more than 5th FP (2.5 years) under the Certified Public Accountants Act.