Acquisition of External Certification

Acquisition of External Certification

We have identified the acquisition of environmental and energy-saving certifications as one of our materialities and have set a target of increasing the proportion of properties in our portfolio (based on total floor space) acquiring these certifications to at least 30% by FY2030.

≪Percentage of environmental and energy-saving certifications*1≫

|

Number of |

Total floor space |

Percentage of |

Targets |

||

|---|---|---|---|---|---|

|

Environmental and energy-saving certifications |

27*2 | 330,696.32 ㎡ |

32.2 % |

30.0% or more (by total floor space) |

|

| Breakdown | CASBEE certification | 26 |

322,275.01 ㎡ |

31.4 % | |

| BELS certification | 2 |

8,421.31 ㎡ |

0.1 % | ||

*1 As of end of January 2024.

*2 Excludes duplication of CASBEE certification and BELS certification for the same property.

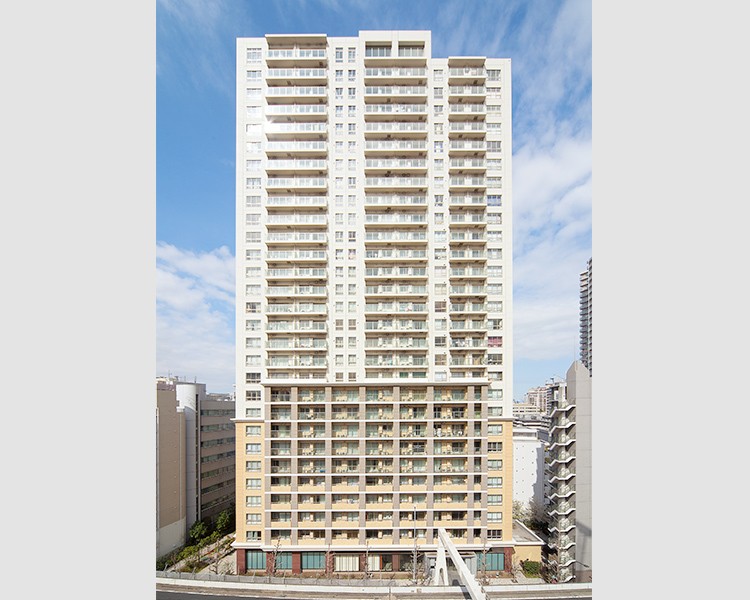

Awarded “ CASBEE” Certification

Comprehensive Assessment System for Built Environment Efficiency (CASBEE) is a method for evaluating and rating the environmental performance of buildings. It is a comprehensive assessment regarding the reduction of environmental loads such as conservation of energy and resources as well as the quality of a building including interior comfort and scenic aesthetics. The CASBEE rankings include “S”, “A”, “B+”, and “B,” in descending order.

S Rank ★★★★★

A Rank ★★★★

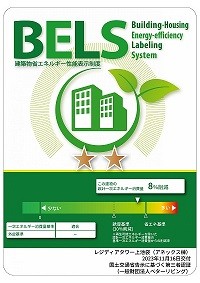

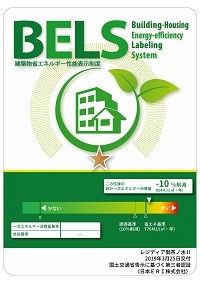

Awarded “Building-Housing Energy-efficiency Labeling System (BELS)” Certification

BELS (Building-Housing Energy-efficiency Labeling System) is a third party certification system in Japan that displays the energy saving performance of buildings. Real estate companies (and others) are required to strive to display the energy-saving performance of buildings based on the Act on the Improvement of Energy Consumption Performance of Buildings (“Building Energy Efficiency Act”). BELS is evaluated based on the guidelines for energy saving performance display of buildings set by the Ministry of Land, Infrastructure, Transport and Tourism, and the certification rating is represented by the numbers of stars on a five-tire (one star “★” to five stars “★★★★★”) evaluation scale.

For details about BELS , please refer to the URL below (Japanese only) :

https://www.hyoukakyoukai.or.jp

★★

★

Participation in GRESB Assessment

In 2014 ADR became the first residential J-REIT* to participate in the GRESB** Real Estate Assessment.

In the FY2023 GRESB Real Estate Assessment, ADR has been selected as a “Sector Leader” in the Listed Residential sector in Asia for the fourth consecutive year and first time selected as “Asia Sector Leader” for all listed and unlisted participant.

In addition, ADR received a high “4 Stars” rating for second consecutive year, the higher rank out of five levels in the GRESB rating which indicates a relative evaluation based on the global ranking of the overall score,and has been awarded the “Green Star” rating, which is given to operators that are evaluated as excellent in both the “Management Component,” which evaluates ESG promotion policies and organizational structure, and the “Performance Component,” which evaluates the environmental performance of properties owned and initiatives for tenants, for the eighth consecutive year.

Furthermore, ADR received the highest rating of “A” in the ESG disclosure component (“GRESB Disclosure Assessment”) for sixth consecutive years for its efforts in ESG information disclosure.

By continuing to participate in the assessment ADR and its asset manager ITOCHU REIT Management Co., Ltd. (IRM) will strive to improve their quality of the measures they will take in regards of sustainability and score higher in the assessment.

*Residential J-REIT is an investment corporation listed on the Real Estate Investment Trust Securities Market of the Tokyo Stock Exchange whose principal investment is in residential properties and whose portfolio investment ratio in residential properties is 50% or more.

**GRESB is an industry-driven organization established by European pension funds committed to assessing the sustainability performance of real estate portfolios (public, private and direct) around the globe. The dynamic benchmark is used by institutional leading investors in Europe, the U.S. and Asia to engage with their investments in an aim to improve the sustainability performance of their investment portfolio, and the global property sector at large.

Participation in CDP Climate Change Program

ADR participated in CDP* Climate Change Program for the first time in 2023 and received a 'B'score.

*CDP is a global non-profit that runs the world’s environmental disclosure system for companies, cities, states and regions. Founded in 2000 , CDP pioneered using capital markets and corporate procurement to motivate companies to disclose their environmental impacts, and to reduce greenhouse gas emissions, safeguard water resources and protect forests. Over 25,000 organizations around the world disclosed data through CDP in 2023, with more than 23,000 companies – including listed companies worth two thirds global market capitalization - and over 1,100 cities, states and regions. CDP scores are evaluated on 8 levels: Leadership level (A, A-), Management level (B, B-), Awareness level (C, C-), and Disclosure level (D, D-).

For more information on this evaluation, please refer to the website of CDP

https://www.cdp.net/en

Acquisition of SBT Certification

ADR obtained SBT* certification in March 2023 for our GHG emissions reduction target by FY2030 (reducing the total amount by 51% from the FY 2018 level), as Science Based Targets, which is consistent with the level required by the Paris Agreement.

*SBT (Science Based Targets: emission reduction targets based on scientific evidence) is GHG emission reduction targets set by companies that are consistent with the levels required by the Paris Agreement (which aims to limit the global temperature increase to well below 2°C above pre-industrial levels and and pursuing efforts to limit warming to 1.5°C). The SBT Initiative is an international initiative of CDP, the United Nations Global Compact (UNGC), the World Resources Institute (WRI), and the World Wide Fund for Nature (WWF) to certify companies that set SBT.

MSCI ESG Ratings 'A'

The MSCI ESG Ratings investigate, analyse and rate the extent to which companies adequately manage ESG-related risks and opportunities, and provide an overall corporate ESG rating on a seven-point scale from 'AAA' to 'CCC'.

As of April 2023, ADR received an MSCI ESG Rating of 'A'.

*Disclamer

The use by ADR of any MSCI ESG Research LLC or its affiliates ("MSCI") data, and the use of MSCI logos, trademarks, service marks or index names herein, do not constitute a sponsorship, endorsement, recommendation, or promotion of MSCI by MSCI. MSCI services and data are the property of MSCI or its information providers and are provided "as-is" and without warranty. MSCI names and logos are trademarks or service marks of MSCI.

Participation in RobecoSAM's CSR Rating

In 2018, ADR became the first residential J-REIT to be rated on its CSR performance by RobecoSAM, This CSR rating is used to determine constituent companies of Dow Jones Sustainability Diversified Index Series.

Participation in Japan Climate Initiative

ADR and IRM subscribes to the fundamental principles of Japan Climate Initiative (JCI) and became a member in July 2019.

Following the establishment of the “Paris Agreement” for the prevention of global warming in 2015, JCI was established by a coalition of Japanese corporations, municipalities NGOs. Members of JCI aims to voluntarily and actively engaged in climate change countermeasures to realize a decarbonize society.

For more information on this issue, please visit the Japan Climate Initiative website.