Measures to Insure Fair Handling of Transactions with Conflict of Interests

The asset management company (IRM) has established rules and rigorous check system to insure fair handling of asset management transactions with conflict of interests.

IRM determined that there are two situations when conflicts of interests must be managed.

- When deciding who has the first look right for the same acquisition opportunity among ADR and other investment funds of which IRM manages their assets.

- When ADR transacts with related parties.

Prevention of Conflicts of Interests Between ADR and Private Real Estate Investment Funds

IRM may entrust with the management of assets from other investment corporations and private real estate investment funds ("other funds") in addition to ADR, investment targets may overlap with other funds.

For this reason, IRM shall prevent the profits of ADR from being harmed, prevent conflicts of interests between ADR and other funds, and IRM shall apply applicable laws and the investment management agreement, IRM have established “The Regulations on Allocation of Acquisition Opportunities.”

Managing Conflicts of Interests in Related Party Transactions

1. Bylaw on Related Party Transactions

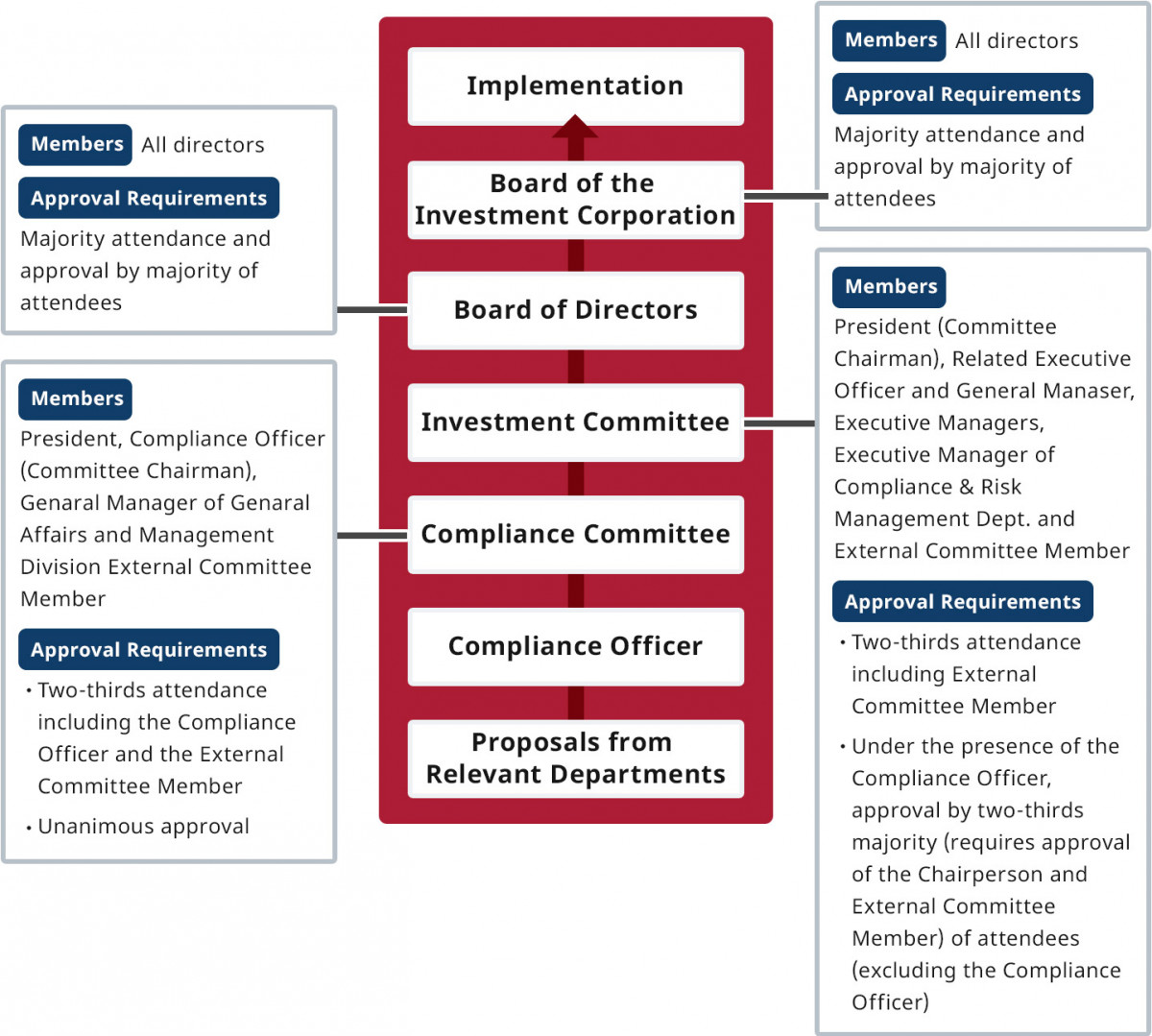

When ADR acquires/disposes assets from related parties, the transaction must go through the following authorization procedures set forth in the bylaw.

(Please refer to the diagram "Flow of Decision-Making for Asset Acquisition and Disposal”)

2. Authorization Procedures Set forth in the Bylaw

- All transactions with related parties, excluding one-time transactions with a value of less than 10 million yen and annual transaction value less than 30 million yen for ongoing transaction, must be deliberated to identify risks and compliance issues and receive approval from IRM 's Compliance Committee which includes an external independent member (a person having a specialized knowledge on compliance, appointed by IRM’s Board of Directors).

- The Compliance Officer is to report the Compliance Committee’s deliberations and the decisions to the Investment Committee.

- After the deliberation by IRM 's Investment Committee consisting an external independent member (a person having a professional knowledge on REIT’s investment management appointed by the IRM’s Board of Directors), it approves the transaction and report the progress of deliberation and approval details by the Investment Committee of ADR to the Board of Directors of IRM and discuss the deliberation items.

- Upon obtaining the approval of the Investment Committee and the Board of Directors of IRM of the preceding item, the Board of Directors of ADR shall be submitted for approval. After obtaining approval from the Board of Directors of ADR, the content of the resolution shall be reported to the Board of Directors of IRM.

- Notwithstanding the provisions of item 2 above, if the approval of the Investment Committee and the Board of Directors of IRM is suspended, the approval may be given by the Board of Directors of ADR prior to the Investment Committee and the Board of Directors of IRM.

3. Definition of Related Parties

- Related-parties defined in Article 201(1) of the Act on Investment Trust and Investment Corporation

- All shareholders (excluding ① ) with voting rights, officers and directors of the asset management company

- A special purpose company (stipulated in the Act on Liquidation of Assets) that may have a significant influence on the decision-making of the asset management company or any of the above (1) or (2) Including target companies, limited liability companies, joint-stock companies, etc., excluding those who fall under 01.)

・A special purpose company (stipulated in the Act on Liquidation of Assets) that may have a significant influence on the decision-making of the asset management company or any of the above 01. or 02. Including target companies, limited liability companies, joint-stock companies, etc., excluding those who fall under 01.)

・have a majority investment, silent partnership investment or preferential investment

・The majority of the officers and employees of the asset management company or those who fall under any of 01. or 02. Above

4. Scope of Related Party Transactions

- Acquisitions from Related Parties

Properties must not be acquired for more than the appraised value by an independent real estate appraiser. For specified assets other than properties, it must not be acquired for more than the market value. In either transactions, prior approval from ADR’s Board of Directors must be obtained. - Acquisitions through Related Parties

Broker fees must be within the range specified in Article 46 of the Real Estate Brokerage Act and decided based on the value and difficulty of the transaction. - Dispositions to Related Parties

Properties must not be disposed for less than the appraised value by an independent real estate appraiser. For specified assets other than properties, it must not be disposed for less than the market value. In either transactions, prior approval from ADR directors’ board must be obtained prior to the transaction. - Real Estate Leasing to related parties

When leasing properties to related parties, the terms must be appropriately determined based on market price. - Real Estate Leasing through Related Party Real Estate Agency

Commissions must be within the range specified in Article 46 of the Real Estate Brokerage Act and decided based on the value and difficulty of the transaction. - Property Management by Related Parties

When selecting a property manager (PM) the criteria should be based on the managers’ track record and creditworthiness, while PM fees should be based on competing quotes obtained from multiple sources, market rates, services provided and workload. - Placing Construction Orders to Related Parties

Construction orders should be placed at an appropriate price determined by referring to estimates obtained from a qualified third party, in addition to contractor's track record and creditworthiness.

5. Notifying ADR on Transactions with Potential Conflicts Interestsof Interests

In order to avoid the asset managing company from inappropriately conducting transactions defined in the Regulation for Enforcement of the Act on Investment Trusts and Investment Corporations between ADR, IRM, IRM’s directors, other REIT that IRM manages their asset and other related parties due to conflict of interests, IRM must prepare a brief letter describing the details of the transaction and give notice to ADR.

6. Appraisal by third parties

When ADR acquires or disposes any specified assets, an appraisal must be conducted by a qualified independent appraiser.

7. Transactions between managed funds

When ADR and other funds managed by IRM acquire or transfer assets, in some cases, in accordance with laws and regulations, internal regulations of asset management companies, etc., care shall be taken not to cause conflicts of interest between mutual funds, and in certain cases, such transactions shall not be conducted.