General Description

Advance Residence Investment Corporation (Securities code: 3269) is listed on the Real Estate Investment Trust Securities Market of Tokyo Stock Exchange. ADR has the largest portfolio among the residential REITs in Japan in terms of assets.

ADR Description

| Name | Advance Residence Investment Corporation |

|---|---|

| Representaive | Executive Director Wataru Higuchi |

| Address | 17th Floor, Jinbocho Mitsui Building 1-105 Kanda-Jinbocho, Chiyoda Ward, Tokyo |

| Investment asset class | Residential Property |

| Fiscal period | Six-month period from Feb.1 to Jul.31, and Aug.1 to Jan.31 |

| Asset manager(Administrative contact) | ITOCHU REIT Management Co., Ltd TEL:+81-3-6821-5483 |

| Major share holders of Asset manager | ITOCHU Corporation ITOCHU Property Development, Ltd. |

History

| Sep. 25, 2009 | Merger agreement was signed between Advance Residence and Nippon Residential. |

|---|---|

| Nov. 30, 2009 | Unitholders of both REITs approve the merger at each of its General Unitholders' Meetings. |

| Feb. 23, 2010 | The last day of trading on the Tokyo Stock Exchange REIT section for both former Advance Residence and Nippon Residential. |

| Feb. 24, 2010 | Both REITs de-list from the Tokyo Stock Exchange. |

| Mar. 1, 2010 | The merger comes in to effect and the new Advance Residence is established. |

| Mar. 2, 2010 | The new Advance Residence (Securities code: 3269) re-lists on the Tokyo Stock Exchange REIT section. |

Directors

Executive Director Wataru Higuchi (male)

| Oct. 1993 | Registered as assistant certified public accountant |

|---|---|

| Oct. 1993 | Joined Tohmatsu & Co. |

| Apr. 1997 | Registered as certified public accountant |

| Apr. 2001 | Enrolled in the Judicial Research and Training Institute |

| Oct. 2002 | Registered as an attorney |

| Oct. 2002 | Joined Seiwameitetsu Law Office |

| Oct. 2007 | Appointed partner |

| Aug. 2012 | Registered as a certified fraud examiner |

| Jun. 2016 | Appointed outside director (audit, etc. officer) of Marubeni Construction Material Lease Co., Ltd. (currently service) |

| Oct. 2018 | Appointed representative partner of Ootemon Law Office (currently serving) |

| Jun. 2019 | Appointed outside audit of Organo Corporation (currently serving) |

| Oct. 2019 | Appointed Executive Director of ADR |

Supervisory Director Yoshitsugu Oba (male)

| Nov. 1975 | Joined Tohmatsu Awoki & Co. |

|---|---|

| Jun. 1990 | Partner, Tohmatsu & Co. |

| Oct. 2010 | Quality Control Division Manager, Deloite Touche Tohmatsu |

| Nov. 2010 | Managing Member, Deloite Touche Tohmatsu |

| Oct. 2017 | Appointed Supervisory Director of ADR |

Supervisory Director Satoru Kobayashi (male)

| Nov. 1982 | Passed bar exam |

|---|---|

| Apr. 1985 | Registered as a practicing lawyer |

| Oct. 2005 | Opened Satoru Kobayashi Law Office (currently Esperanza Total Law Offices) as head of the firm (currently serving) |

| Jan. 2013 | Appointed auditor of Kokaido Roppongi |

| Jun. 2014 | Appointed Managing Director, Nichibenren Traffic Accident Consultation Center |

| Jun. 2015 | Appointed Councilor, Automobile Information Network Association (currently serving) |

| Jun. 2015 | Appointed Councilor, Japan Design Number (currently serving) |

| Apr. 2018 | Appointed Director, Nichibenren Traffic Accident Consultation Center (currently serving) |

| Jun. 2018 | Appointed Deputy Chairman, Nichibenren Traffic Accident Consultation Center (currently serving) |

| Oct. 2019 | Appointed Supervisory Director of ADR |

| Jun. 2023 | Appointed Director, Foundation for Orphans from Automobile Accident (currently serving) |

Supervisory Director Aiko Kanayama (female)

| Oct. 2005 | Registered as an attorney |

|---|---|

| Oct. 2005 | Joined Mori Hamada & Matsumoto |

| Apr. 2010 | Joined Ministry of Land, Infrastructure, Transport and Tourism |

| May. 2014 | Completed LL.M. program of University of California, Berkeley, School of Law |

| Oct. 2018 | Appointed Counsel, Public Policy and Government Affairs, Google Japan G.K. |

| Jan. 2019 | Joined Miura & Partners as partner (currently serving) |

| Sep. 2021 | Appointed member of Committee for Housing Dispute Settlement Agency, Daini-Tokyo Bar Association (currently serving) |

| Jun. 2022 | Appointed Digital Adviser to Policy Bureau, Ministry of Land, Infrastructure, Transport and Tourism (legal affairs) (currently serving) |

| Nov. 2023 | Appointed Supervisory Director of ADR |

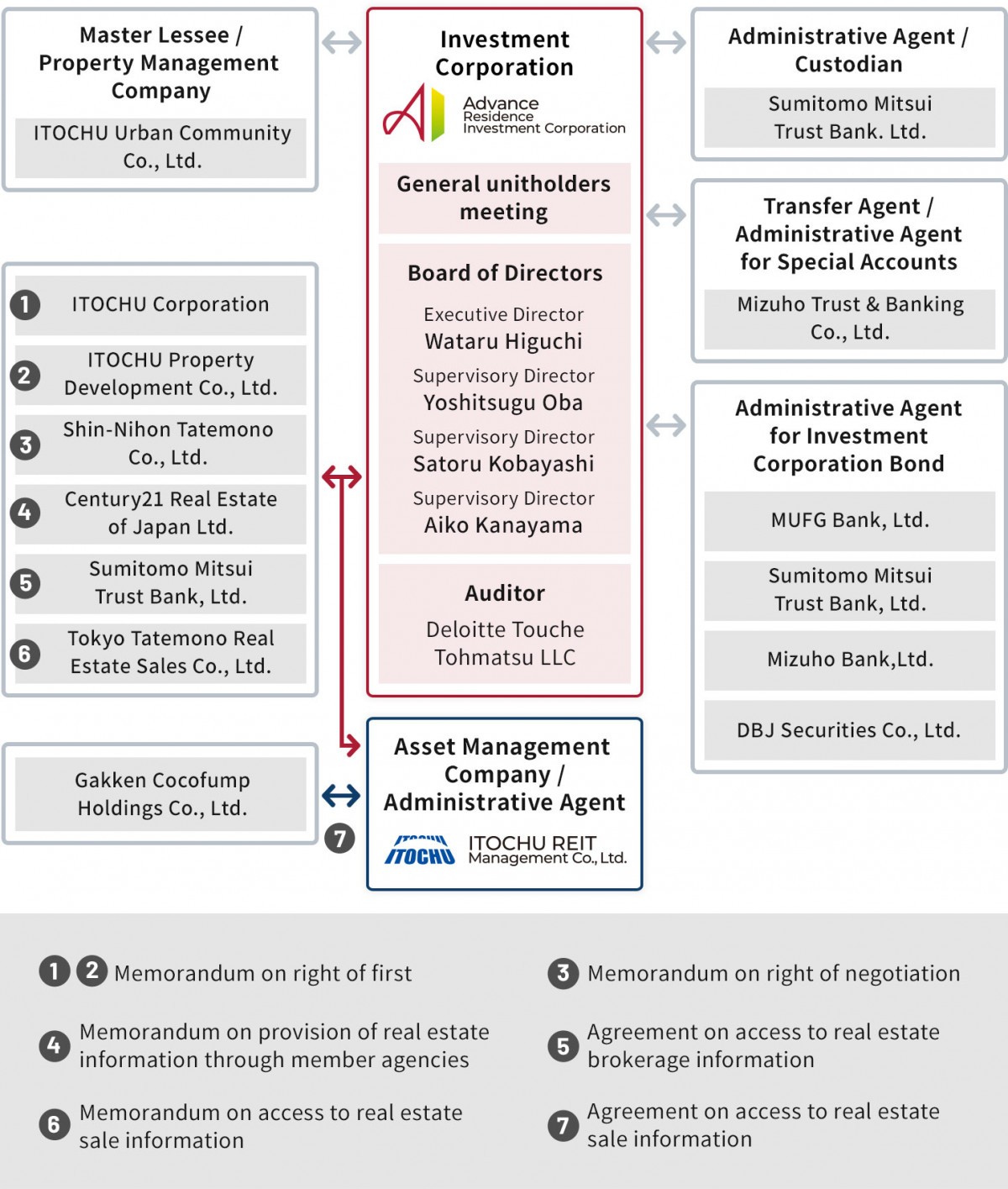

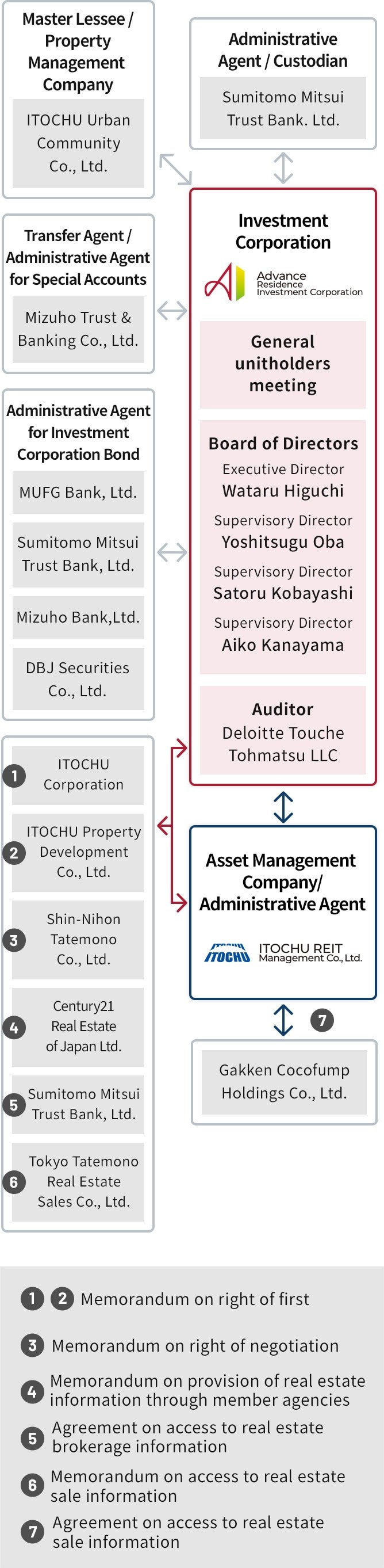

- Investment corporation outsources asset management, custody, administration, etc. in accordance to the law "Act on Investment Trusts and Investment Corporations". ADR has a board of directors consisting of executive director and supervisory officers, but legally prohibited to employ employees.

The ITOCHU Collaboration

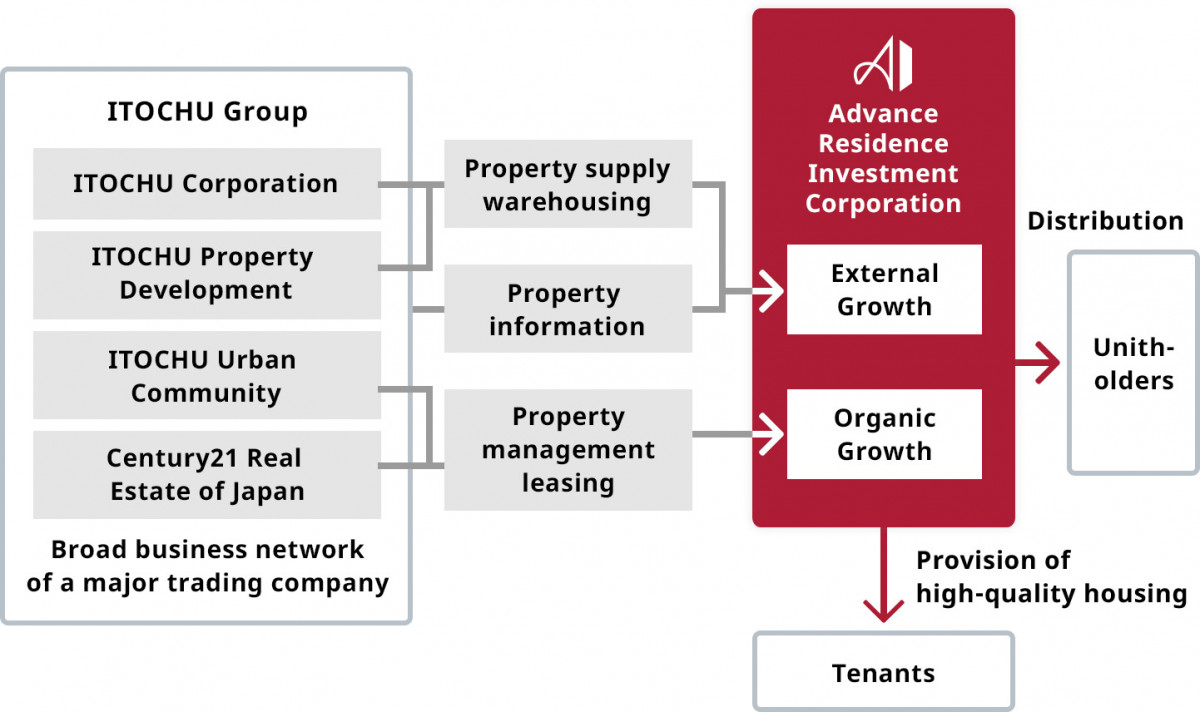

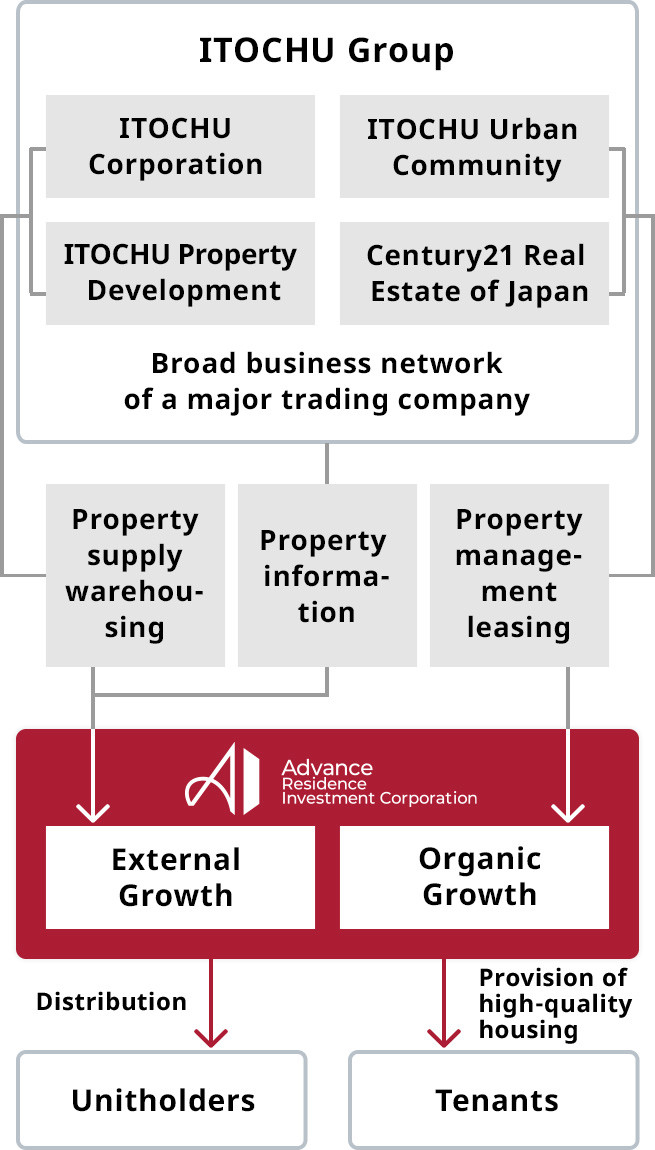

ADR will achieve its basic strategy through multi-dimensional support such as the provision of properties, the sourcing of property information and property management by optimally applying the strong business foundation of the ITOCHU Group and its support companies.

ITOCHU Support

Collaboration with the ITOCHU Group

Acquisition of Properties from ITOCHU Support Line Companies

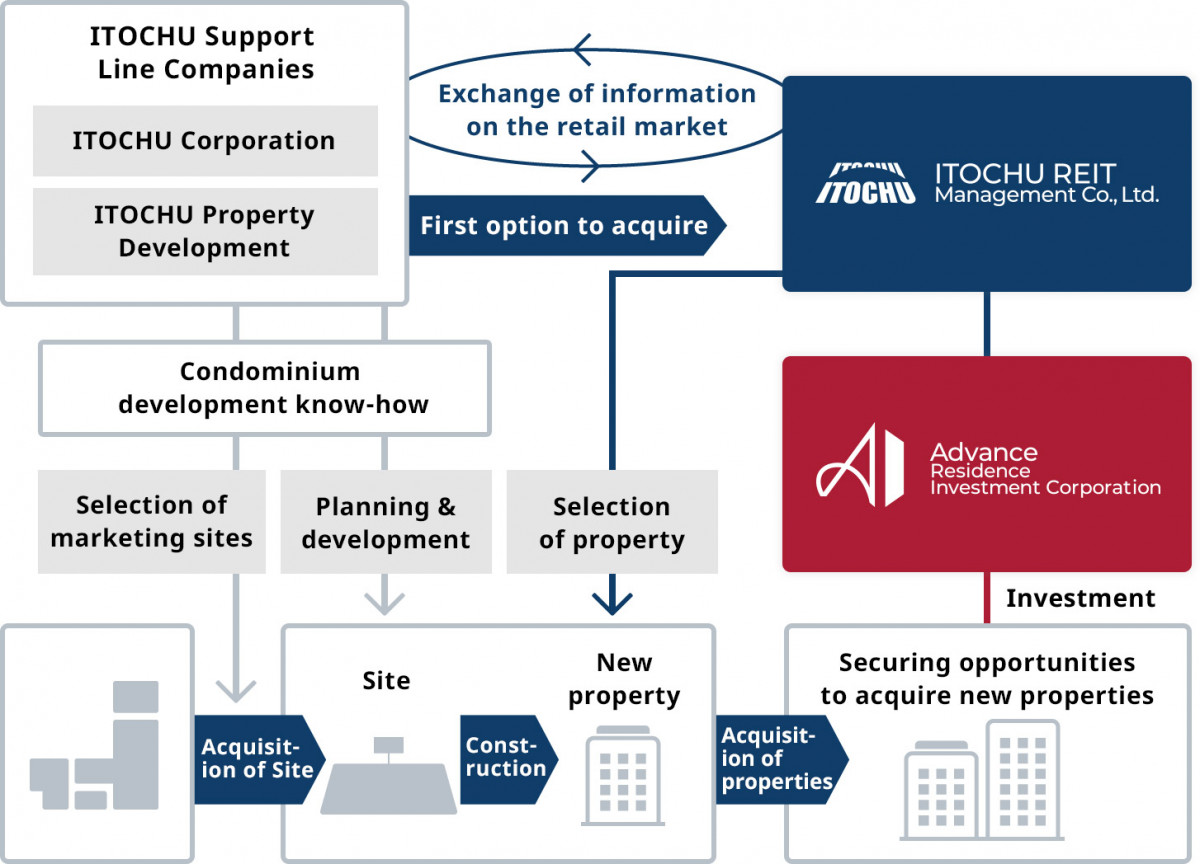

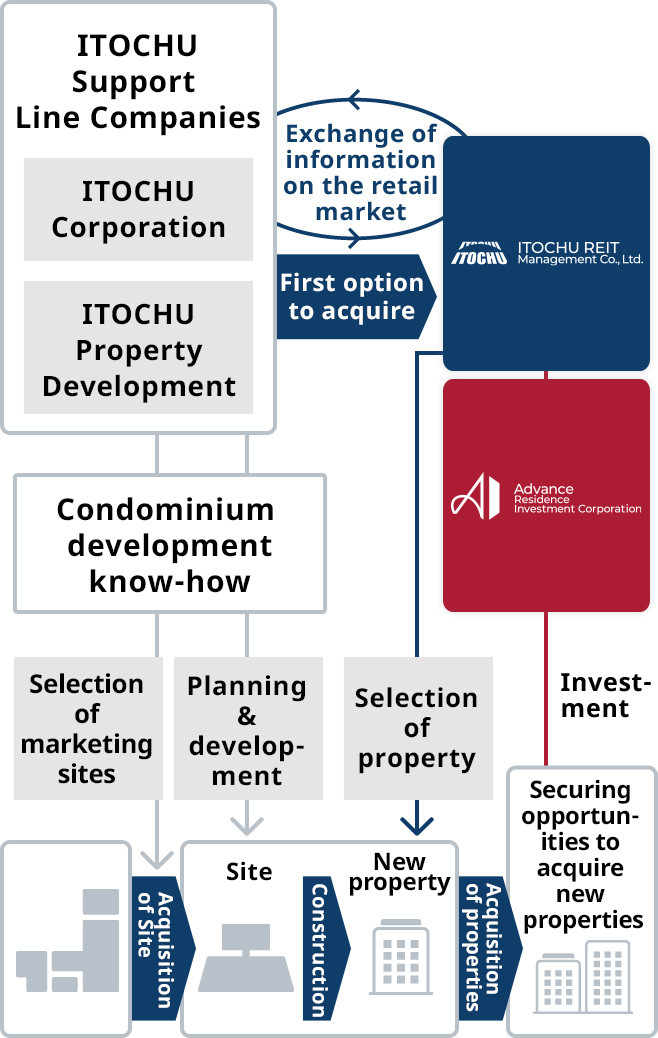

ADR and its asset management company are fully utilizing ITOCHU support line companies to enable steady growth over the medium to long term. Thereby securing a preferential opportunity to acquire properties (note) that have been planned and developed by ITOCHU support line companies boasting a wealth of experience in developing for-sale condominiums.

(Note) Properties include properties planned and developed by ITOCHU support line companies or by SPCs where ITOCHU support line companies are the asset managers or have equity interests as a silent partner.

- IRM are convinced that this will enable ADR to secure opportunities to acquire new properties of sustained quality based on the condominium development know-how of ITOCHU support line companies.

- In addition to increasing the development of properties that meet the investment policy of ADR, IRM believe that the exchange of information on the rental market, and debate on and examination of the commercial viability of rental housing issued between the asset manager and ITOCHU support line companies will generate even more opportunities for ADR to acquire properties.