Supported Initiatives/External Evaluations

Supported Initiatives/External Evaluations

Acquisition of environmental and energy-saving certifications

We have identified the acquisition of environmental and energy-saving certifications as one of our materialities and have set a target of increasing the proportion of properties in our portfolio (based on total floor space) acquiring these certifications to at least 30% by FY2030.

≪Percentage of environmental and energy-saving certifications*1≫

|

Number of |

Total floor space |

Percentage of |

Targets |

||

|---|---|---|---|---|---|

|

Environmental and energy-saving certifications |

31*2 | 343,653.97 ㎡ |

33.4 % |

30.0% or more (by total floor space) |

|

| Breakdown | DBJ Green Building certificatuin | 1 |

6,845.00 ㎡ |

0.7 % | |

| CASBEE certification | 27 | 325,020.31 ㎡ | 31.6 % | ||

| BELS certification | 4 |

11,788.66 ㎡ |

1.1 % | ||

*1 As of the end of July 2025.

*2 Excludes duplication of CASBEE certification and BELS certification for the same property.

Awarded “DBJ Green Building” Certification

DBJ Green Building Certification is a certificate developed by Development Bank of Japan Inc. (DBJ) to identify and certify real estate properties that satisfy various social needs including environmental quality. Please refer to the following sites for details.

Development Bank of Japan Inc.

DBJ Green Building

Five Stars ★★★★★

Properties with the best class environmental & social awareness

Awarded “CASBEE” Certification

Comprehensive Assessment System for Built Environment Efficiency (CASBEE) is a method for evaluating and rating the environmental performance of buildings. It is a comprehensive assessment regarding the reduction of environmental loads such as conservation of energy and resources as well as the quality of a building including interior comfort and scenic aesthetics. The CASBEE rankings include “S”, “A”, “B+”, and “B,” in descending order.

S Rank ★★★★★

A Rank ★★★★

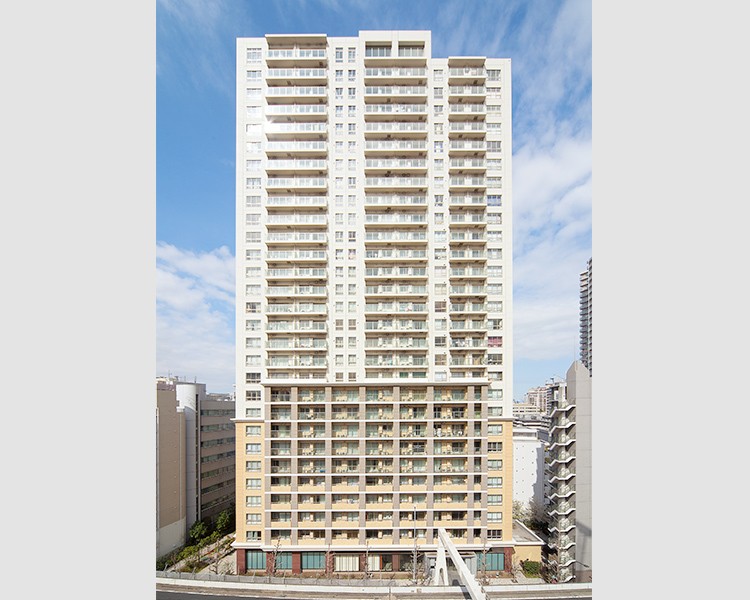

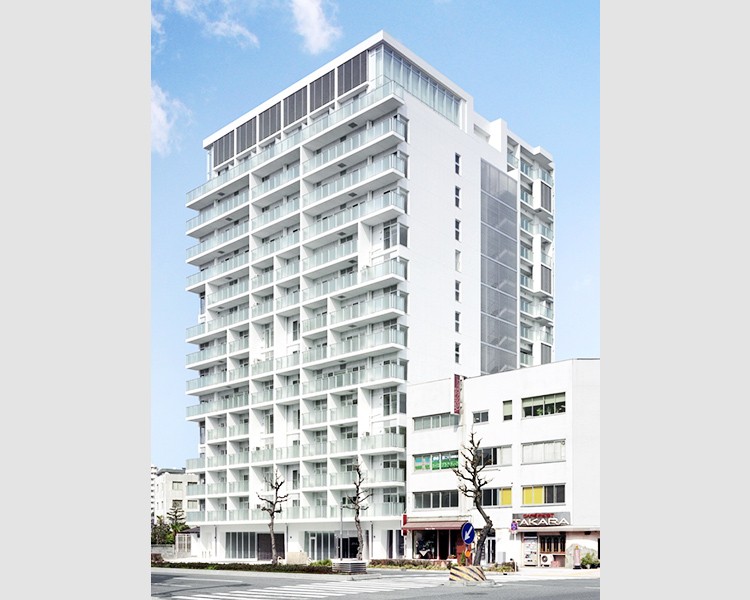

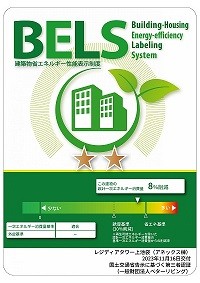

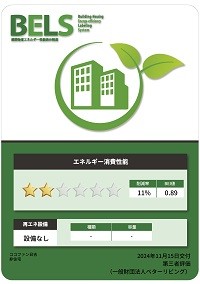

Awarded “Building-Housing Energy-efficiency Labeling System (BELS)” Certification

BELS (Building-Housing Energy-efficiency Labeling System) is a third party certification system in Japan that displays the energy saving performance of buildings. Real estate companies (and others) are required to strive to display the energy-saving performance of buildings based on the Act on the Improvement of Energy Consumption Performance of Buildings (“Building Energy Efficiency Act”). BELS is evaluated based on the guidelines for energy saving performance display of buildings set by the Ministry of Land, Infrastructure, Transport and Tourism, and from April 1, 2024, the evaluation will be displayed in seven levels (no stars to “★★★★★”) for non-residential buildings and houses with renewable energy equipment, and in five levels (no stars to “★★★★”) for houses without renewable energy equipment.

For details about BELS , please refer to the URL below (Japanese only) :

https://www.hyoukakyoukai.or.jp

★★

Cocofump Hiyoshi ※Acquisition of evaluation for non-residential areas

★

Participation in GRESB Assessment

In 2014 ADR became the first specialized residential J-REIT* to participate in the GRESB** Real Estate Assessment.

In the FY2025 GRESB Real Estate Assessment, ADR received a “3 Stars” rating , the third-higher rank out of five levels in the GRESB rating which indicates a relative evaluation based on the global ranking of the overall score, and has been awarded the “Green Star” rating, which is given to operators that are evaluated as excellent in both the “Management Component,” which evaluates ESG promotion policies and organizational structure, and the “Performance Component,” which evaluates the environmental performance of properties owned and initiatives for tenants, for the 10th consecutive year.

In addition, ADR received the highest rating of “A” in the ESG disclosure component (“GRESB Disclosure Assessment”) for 8th consecutive years for its efforts in ESG information disclosure.

Furthermore, in the newly introduced Residential Assessment for 2025, ADR achieved the highest ranking among the participating entities in Asia and has been selected as “Asia Top Performer”.

By continuing to participate in the assessment ADR and its asset manager ITOCHU REIT Management Co., Ltd. (IRM) will strive to improve their quality of the measures they will take in regards of sustainability and score higher in the assessment.

*Specialized residential J-REIT is an investment corporation listed on the Real Estate Investment Trust Securities Market of the Tokyo Stock Exchange whose principal investment is in residential properties and whose portfolio investment ratio in residential properties is 90% or more.

**GRESB is an industry-driven organization established by European pension funds committed to assessing the sustainability performance of real estate portfolios (public, private and direct) around the globe. The dynamic benchmark is used by institutional leading investors in Europe, the U.S. and Asia to engage with their investments in an aim to improve the sustainability performance of their investment portfolio, and the global property sector at large.

***In the 2025 assessment, GRESB has introduced a Residential Component as a benchmarking tool for residential assets. The Residential Component consists of new questions tailored to the characteristics of residential assets. Real estate participants whose portfolios consist of more than 75% residential assets by Gross Asset Value (GAV) may submit responses. Participants receive a standalone Sector Insight: Residential report alongside the GRESB Benchmark Report. The residential score is derived by removing and restructuring indicators with limited relevance to residential assets and adjusting scoring weights. Please note that the Residential Assessment is not intended to replace the main Real Estate Assessment but is positioned as a supplementary evaluation

****Top Performers are the best performers by sector and region from across the GRESB Residential Assessment. The entity with the top score, as well as the entities with a score within 1 point of the top score in a category will be recognized as a Top Performer.

Participation in CDP

ADR was selected for the “A List” of companies with the highest score of “A” for Leadership level for the second consecutive year, in response to the 2025 CDP Climate Change questionnaire.

*CDP is a global non-profit that runs the world’s only independent environmental disclosure system. Aligned with the ISSB’s climate standard, IFRS S2, as its foundational baseline, CDP integrates best-practice reporting standards and frameworks in one place. In 2025, more than 22,100 companies disclosed environmental information through CDP. In addition, financial institutions with more than a quarter of the world’s institutional assets use CDP data to help inform investment and lending decisions. CDP scores are evaluated on 8 levels: Leadership level (A, A-), Management level (B, B-), Awareness level (C, C-), and Disclosure level (D, D-).

For more information on this evaluation, please refer to the website of CDP

https://www.cdp.net/en

Acquisition of SBT Certification

ADR obtained SBT* certification in March 2023 for our GHG emissions reduction target by FY2030 (reducing the total amount by 51% from the FY 2018 level), as Science Based Targets, which is consistent with the level required by the Paris Agreement.

*SBT (Science Based Targets: emission reduction targets based on scientific evidence) is GHG emission reduction targets set by companies that are consistent with the levels required by the Paris Agreement (which aims to limit the global temperature increase to well below 2°C above pre-industrial levels and and pursuing efforts to limit warming to 1.5°C). The SBT Initiative is an international initiative of CDP, the United Nations Global Compact (UNGC), the World Resources Institute (WRI), and the World Wide Fund for Nature (WWF) to certify companies that set SBT.

MSCI ESG Ratings 'A'

The MSCI ESG Ratings investigate, analyse and rate the extent to which companies adequately manage ESG-related risks and opportunities, and provide an overall corporate ESG rating on a seven-point scale from 'AAA' to 'CCC'.

Since 2021, ADR has maintained an MSCI ESG Rating of 'A' (as of May 2025).

*Disclamer

The use by ADR of any MSCI ESG Research LLC or its affiliates ("MSCI") data, and the use of MSCI logos, trademarks, service marks or index names herein, do not constitute a sponsorship, endorsement, recommendation, or promotion of MSCI by MSCI. MSCI services and data are the property of MSCI or its information providers and are provided "as-is" and without warranty. MSCI names and logos are trademarks or service marks of MSCI.

Principles for Responsible Investment

PRI is an investor initiative in partnership with UNEP Finance and the UN Global Compact to support the integration of ESG factors into investment and ownership decisions and to achieve a sustainable international financial system.

IRM is a signatory to the PRI, We subscribes to the PRI philosophy and the following principles.

【Principles for Responsible Investment】

- We will incorporate ESG issues into investment analysis and decision-making processes.

- We will be active owners and incorporate ESG issues into our ownership policies and practices.

- We will seek appropriate disclosure on ESG issues by the entities in which we invest.

- We will promote acceptance and implementation of the Principles within the investment industry.

- We will work together to enhance our effectiveness in implementing the Principles.

- We will each report on our activities and progress towards implementing the Principles.

TCFD

TCFD was established in 2015 by the Financial Stability Board, which consists of central banks and financial regulators of the world’s major countries. In June 2017, TCFD issued recommendations urging companies to disclose information on climate-related business risks and opportunities in the medium to long term, their impact on corporate finances, specific actions and strategies to address those risks, and other factors in order to mitigate risks that could destabilize financial markets.

IRM expressed its support for the recommendations in March 2020 and also joined the TCFD Consortium for the purpose of networking on TCFD.

Participation in Japan Climate Initiative

ADR and IRM subscribes to the fundamental principles of Japan Climate Initiative (JCI) and became a member in July 2019.

Following the establishment of the “Paris Agreement” for the prevention of global warming in 2015, JCI was established by a coalition of Japanese corporations, municipalities NGOs. Members of JCI aims to realize a decarbonized society as required by the Paris Agreement through such measures as achieving carbon neutrality by 2050.

For more information on this issue, please visit the Japan Climate Initiative website.

The TNFD Forum

The Taskforce on Nature-related Financial Disclosures (TNFD) is a global initiative established to develop a framework for organizations to report and act on evolving nature-related risks.

The TNFD Forum is a platform for organizations to signal their support for the TNFD’s ongoing work and to stay informed of its latest developments. IRM joined the Forum in April 2025.

For more information on this issue, please visit TNFD Forum website.

Registration as a TNFD Adopter

ADR has registered as a “TNFD Adopter” to express its commitment to adopting the TNFD recommendations and disclosing nature-related information based on a framework aligned with these recommendations. A “TNFD Adopter” refers to an organization that has declared its intention to disclose information aligned with the TNFD recommendations in either fiscal year 2024, 2025, or 2026. Moving forward, ADR will advance initiatives aligned with the TNFD recommendations and enhance its disclosures as a TNFD Adopter.

For more information on this issue, please visit TNFD Adopters website.